The US Dollar (USD) is beginning to rise as markets brace for a potentially turbulent 24 hours, starting with the release of the Federal Reserve (Fed) Minutes from the recent Federal Open Market Committee (FOMC) meeting, which maintained the status quo on interest rates. While this report can often move markets, expectations are tempered this time because numerous Fed officials have spoken since Monday, consistently supporting the decision to keep rates steady with no immediate hikes anticipated. Following this, the highly anticipated earnings report from Nvidia (NVDA) could significantly influence market sentiment, setting the stage for either a risk-on or risk-off environment ahead of a busy Thursday filled with various US economic data releases.

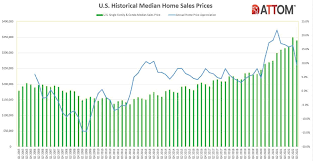

Wednesday’s economic data calendar is relatively light, with Existing Home Sales being the primary focus. Another decline in home sales would further illustrate the waning sentiment of US exceptionalism, which appears to be nearing its end. More activity is expected on Thursday with the release of the usual Jobless Claims numbers.

Daily Digest Market Movers: Another Miss on Housing

Markets were jolted by unexpected inflation data from the United Kingdom, where monthly headline inflation increased by 0.3% against the previous 0.6%, surpassing the anticipated 0.1%. This has led to a reevaluation of major currencies, initially based on expectations of rate cuts from central banks.

Wednesday’s US calendar began with the Mortgage Bankers Association Survey, which reported a 1.9% increase in mortgage applications this week, following a steady 0.5% rise the previous week. At 12:40 GMT, Federal Reserve Bank of Chicago President Austan Goolsbee is scheduled to deliver opening remarks at the Holding Company Symposium hosted by the bank. At 14:00 GMT, the Existing Home Sales numbers for April were released, showing a 1.9% decline, following a 4.3% decrease in March.

The spotlight, however, will be on Nvidia’s earnings, expected around 16:00 GMT. This report could significantly influence the market’s risk appetite for the remainder of the trading day. Additionally, at 17:00 GMT, the US Treasury will conduct a 20-year bond auction. The day will conclude with the release of the Fed Minutes at 18:00 GMT.

US equities have remained flat since the US opening bell, with investors eagerly awaiting Nvidia’s earnings. The CME FedWatch Tool indicates a shift in market expectations, with a 98.4% probability of no change in the policy rate in June, and a 1.6% chance of a hike. Projections for September show a 50.6% likelihood of a 25-basis-point rate cut.

The benchmark 10-year US Treasury Note is trading around 4.43%, near its weekly high, reflecting market anticipation and cautious positioning.

US Dollar Index Technical Analysis: Bouncing Off Support

The US Dollar Index (DXY) is beginning to break out of its tight range ahead of several market-moving events. Nvidia’s earnings might be the primary event for this Wednesday, as their outcome has the potential to set the overall market mood. The influence of a single stock’s earnings on the broader market sentiment highlights the interconnectedness of major financial instruments and market dynamics, which might lead traders to make unexpected moves with the US Dollar Index.

On the technical side, the DXY Index is approaching significant resistance levels. The first level to watch is the 55-day Simple Moving Average (SMA) at 104.74. If the DXY surpasses this, the next targets are 105.12 and 105.52. On the downside, the 100-day SMA around 104.22 serves as a crucial support. If this level is breached, a gap exists between 104.11 and 103.00. Should the decline continue, the March low of 102.35 and the December low of 100.62 are key levels to monitor.

As markets await the release of the Fed Minutes, Nvidia’s earnings, and other economic indicators, traders should brace for potential volatility. The interplay between these events will likely determine the short-term trajectory of the US Dollar and broader financial markets.

In summary, the next 24 hours promise to be significant for the US Dollar and financial markets. The Fed Minutes and Nvidia’s earnings will provide critical insights into the current economic landscape and investor sentiment. Traders should be prepared for potential market shifts and adjust their strategies accordingly, keeping an eye on key technical levels and economic indicators that will guide the market’s direction.