Trade Balance Boosts AUD

On Thursday, the Australian Dollar (AUD) managed to recoup its recent losses against the US Dollar (USD). The AUD/USD pair gained strength following the release of Australia’s Trade Balance data, which widened to 6,548 million in May, surpassing the anticipated 5,500 million and April’s 5,024 million. This improvement in trade balance was primarily driven by a significant 7.2% month-over-month (MoM) decrease in imports, contrasting sharply with April’s 4.2% increase. However, exports continued to decline, falling by 2.5% after a 0.6% drop in the previous month.

Hawkish Signals from the RBA

The appreciation of the Australian Dollar can also be attributed to a hawkish statement by Reserve Bank of Australia (RBA) Governor Michele Bullock on Wednesday. Bullock emphasized that the central bank is prepared to raise interest rates if the Consumer Price Index (CPI) fails to return to the target range of 1%-3%. Additionally, she noted signs of easing in the labor market based on various measures, as reported by NCA NewsWire.

US Dollar Faces Headwinds

In contrast, the US Dollar faced headwinds following the release of mixed economic data in the United States, which has fueled speculation about potential interest rate cuts by the US Federal Reserve (Fed). According to the CME FedWatch Tool, the probability of a Fed rate cut of at least 25 basis points has surged to nearly 70%, up from 47.5% a week earlier. This speculation has been further driven by a decline in US Treasury yields, adding more pressure on the Greenback.

Awaiting Key US Employment Data

Investors are keenly awaiting the key US employment data releases on Friday, which include Average Hourly Earnings and Non-Farm Payrolls. These reports are expected to provide more clarity on the direction of the Fed’s monetary policy.

Mixed US Economic Data

On Wednesday, the ISM US Services PMI jumped to 53.8 in May, its highest level in nine months, significantly beating the forecast of 50.8. Conversely, the ADP US Employment Change report indicated that only 152,000 new jobs were added in May, the lowest in four months and below the forecast of 175,000, as well as April’s downwardly revised figure of 188,000.

Australia’s Economic Indicators

Australia’s Gross Domestic Product (GDP) data released on Wednesday showed a modest growth of 0.1% in the first quarter, falling short of the expected 0.2% increase. On an annual basis, the economy grew by 1.1%, slightly below the anticipated 1.2%. Meanwhile, the Judo Bank Purchasing Managers Index (PMI) came in at 52.5 for May, missing the expected reading of 53.1. The Judo Bank Composite PMI also fell slightly to 52.1 from 53.0 in April, indicating that while Australia’s private sector output continued to grow for the fourth consecutive month, the pace of growth has slowed.

Positive Signs from China’s Economy

China’s economic performance, a crucial factor for the Australian economy given the close trade relationship between the two countries, also showed positive signs. The Caixin China Services PMI for May came in at 54.0, surpassing expectations of 52.6 and the previous figure of 52.5. This marked the 17th consecutive month of expansion in services activity, signaling the fastest pace since July 2023.

Insights from US Fed Officials

In the US, last week saw remarks from Atlanta Fed President Raphael Bostic, who expressed that he doesn’t see the need for further rate hikes to achieve the Fed’s 2% annual inflation target. Similarly, New York Fed President John Williams suggested that while inflation remains too high, it is expected to moderate in the latter half of 2024, reducing the urgency for immediate monetary policy actions.

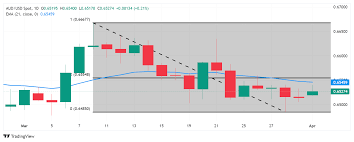

Technical Analysis: Australian Dollar Maintains Bullish Momentum

As of Thursday, the Australian Dollar is trading around 0.6670 against the US Dollar. Technical analysis of the daily chart indicates a bullish bias for the AUD/USD pair, with the pair remaining within a rising wedge pattern. This bullish sentiment is reinforced by the 14-day Relative Strength Index (RSI), which is above the 50 level.

Potential upside targets for the AUD/USD pair include the psychological level of 0.6700, the four-month high of 0.6714, and the upper limit of the rising wedge at around 0.6750. On the downside, immediate support is at the 21-day Exponential Moving Average (EMA) at 0.6634, which aligns with the lower boundary of the rising wedge. Further support is found at the psychological level of 0.6600, and a continued decline could see the pair testing the throwback support region around 0.6470.

Australian Dollar Performance Against Major Currencies

The table below highlights the percentage change of the Australian Dollar (AUD) against major currencies on Thursday. The AUD demonstrated the strongest performance against the New Zealand Dollar (NZD).

| USD | EUR | GBP | CAD | JPY | NZD | CHF | |

|---|---|---|---|---|---|---|---|

| USD | -0.10% | 0.00% | -0.08% | -0.05% | -0.04% | 0.04% | |

| EUR | 0.09% | 0.09% | 0.02% | 0.04% | 0.05% | 0.15% | |

| GBP | 0.00% | -0.09% | -0.08% | -0.06% | -0.04% | 0.05% | |

| CAD | 0.08% | -0.02% | 0.10% | 0.02% | 0.03% | 0.13% | |

| AUD | 0.05% | -0.04% | 0.06% | -0.03% | 0.00% | 0.11% | -0.10% |

| JPY | 0.04% | -0.03% | 0.05% | -0.05% | 0.08% | -0.11% | |

| NZD | -0.04% | -0.15% | -0.05% | -0.13% | -0.11% | -0.20% | |

| CHF | 0.15% | 0.05% | 0.15% | 0.07% | 0.09% | 0.10% |

This heat map illustrates the percentage changes of major currencies against each other, with the base currency selected from the left column and the quote currency from the top row. For instance, choosing the Euro (EUR) from the left column and moving horizontally to the Japanese Yen (JPY) shows the percentage change for EUR/JPY.

Summary

The Australian Dollar’s recent performance reflects a combination of positive domestic economic data, hawkish signals from the RBA, and mixed signals from US economic data, which collectively contribute to its appreciation against the US Dollar. The market will closely monitor upcoming US employment data for further insights into the Fed’s potential monetary policy action.